Impressive Tips About How To Become A Tax Preparer In Ma

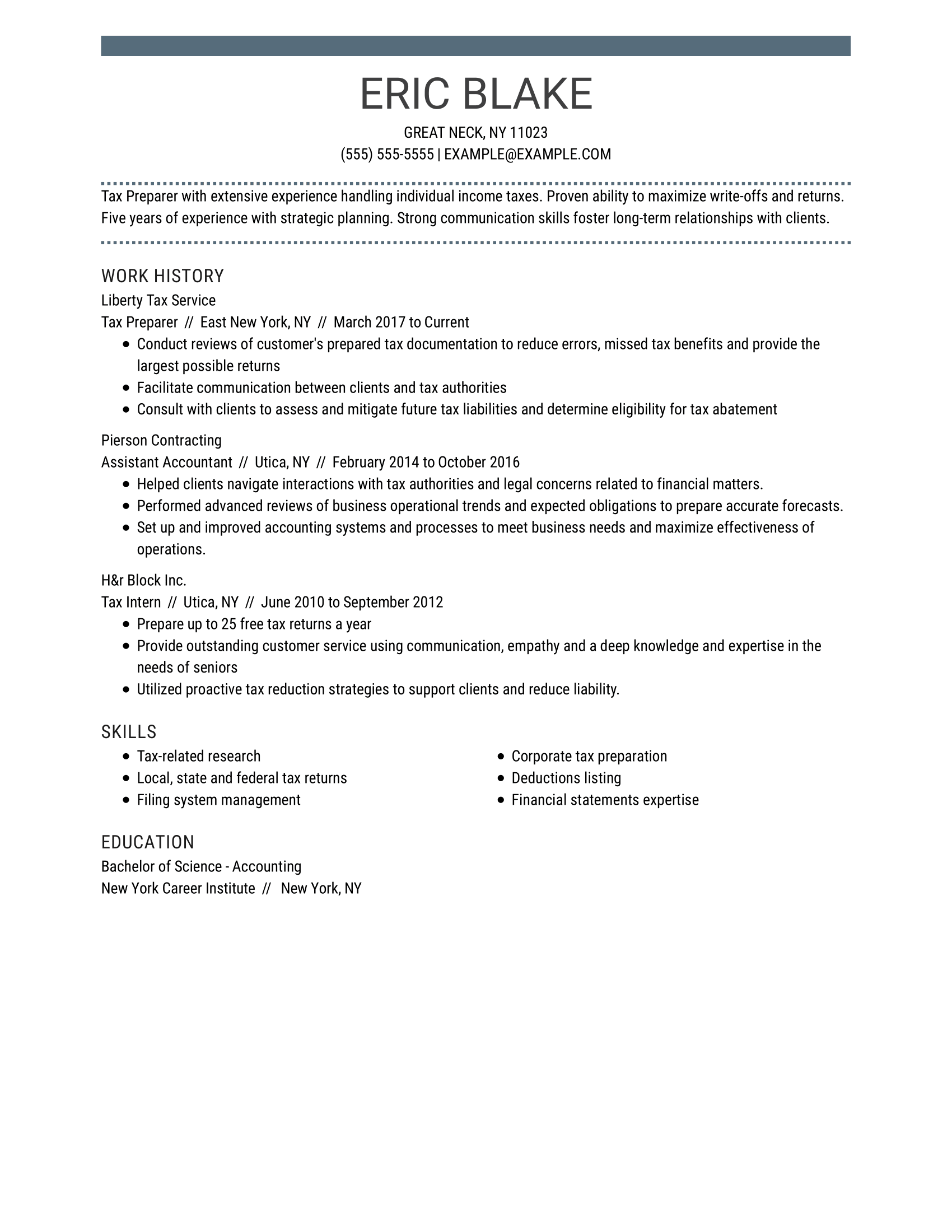

How to become a tax preparer.

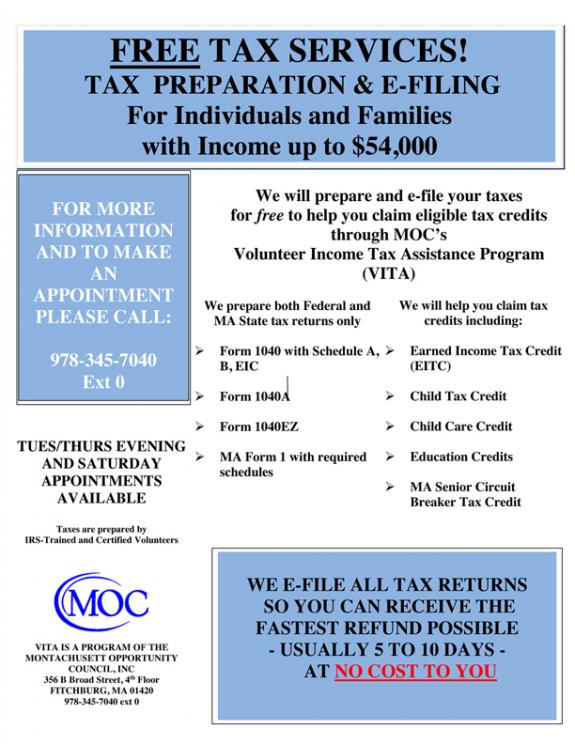

How to become a tax preparer in ma. How to become a tax preparer in 7 steps: A massachusetts tax preparer license can only be obtained through an authorized government agency. Anyone who prepares tax returns and charges a fee for their services is required to have a preparer tax identification.

You need to have a preparer tax identification number or ptin through the irs to become a tax preparer. We'll teach you everything you need to know to make tax prep easy. Understanding the terminology and processes involved in tax preparation is key to success as a tax preparer.

Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal tax returns. However, tax professionals have differing levels of skills, education. Obtain a preparer tax identification number (ptin) from the irs, and pay a $33 registration fee;

We recommend filing on masstaxconnect or through vendor software because it’s fast, easy and provides calculation assistance, instant. How to become a professional tax preparer: To do so, fill out an application and include personal information, such.

Massachusetts tax practitioner institute classes. Getting into the world of tax preparation can feel like learning a whole new. If you must file on paper.

You'll learn about jackson hewitt's unique products and services and how they simplify our customer's lives. Make sure you have right skills for tax preparer. To do so, you must:

![Massachusetts Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/09/Massachusetts-CPA-License-Requirements.jpg)

![Massachusetts Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/09/Education-Requirements-1-1.jpg)