Casual Info About How To Become Licensed Bonded And Insured

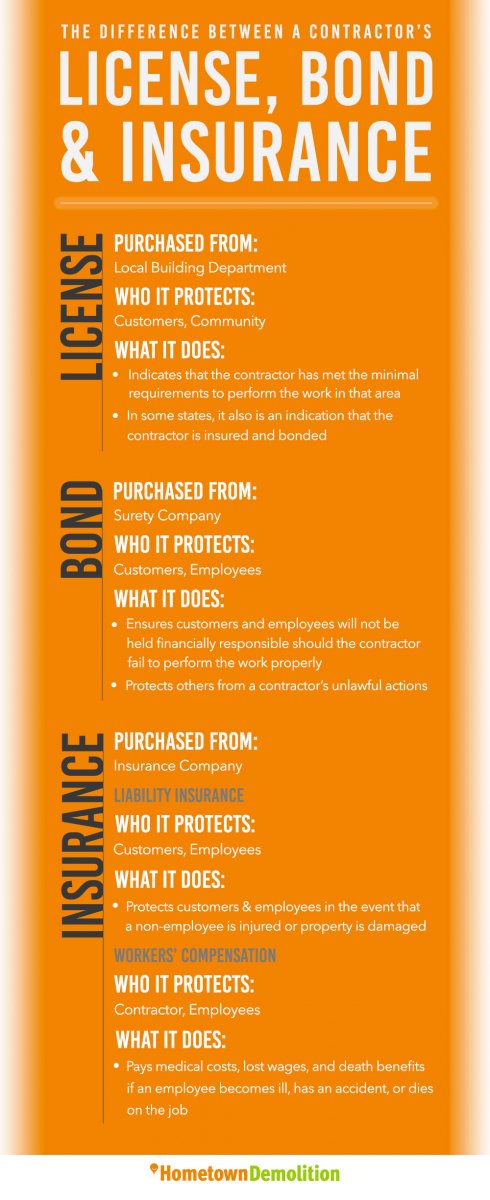

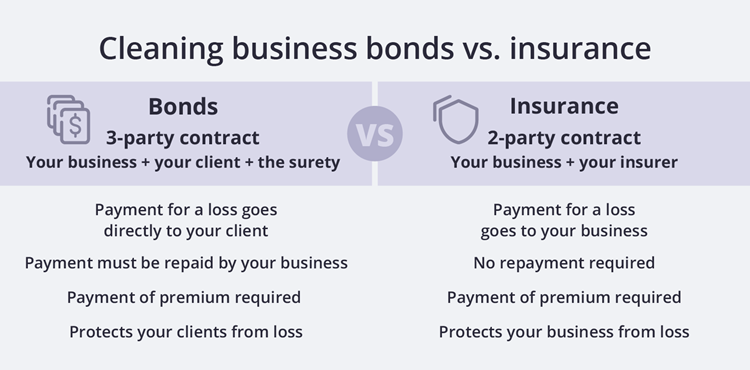

While being insured typically protects the business that is paying for the coverage, being licensed and bonded offers consumers, subcontractors and third party partners a sense.

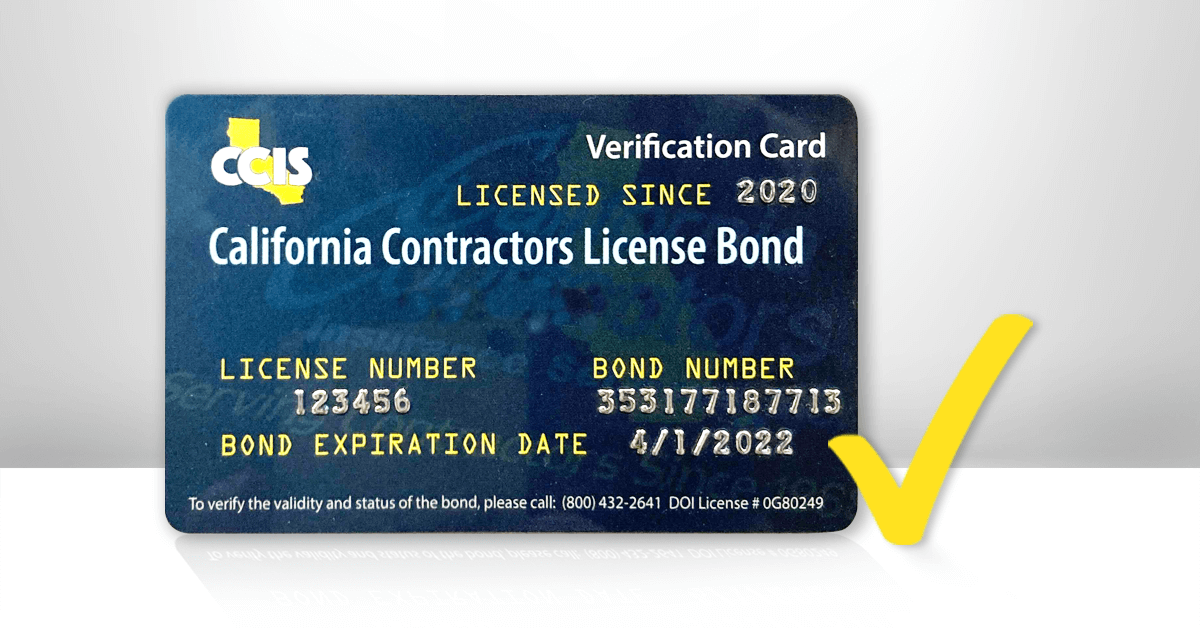

How to become licensed bonded and insured. Costs vary depending upon your profession and the. A bonded contractor is one with whom it’s safe to do business. The principal, the surety, and the obligee.

An insured contractor, on the other hand, means that the contractor can feel safe conducting own their. How to get a license bond. Start by contacting your local chamber of commerce to learn about.

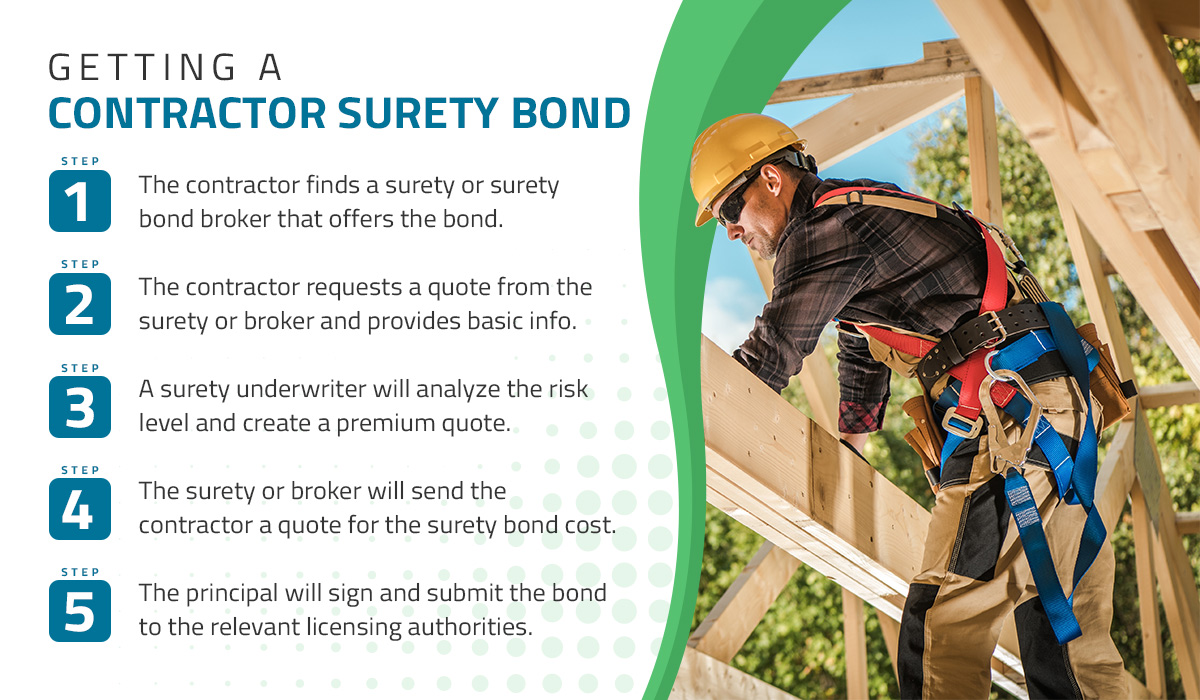

Getting a surety bond can be the easiest part of it when you work with surety bonds. Many insurance brokers may claim they are. First, you’ll have to decide on the type of bond.

A business should be required by an obligee to be bonded, licensed or insured. The principal (you), the obligee (whoever requires you to become bonded), and the surety (the insurance company). Insured are both forms of financial guarantee.

Now that you have a better understanding of the benefits of being bonded, licensed, and insured, you may be wondering. The bond premium is a small fraction of the bond amount. Being licensed, bonded, and insured may not be required in every situation, but it can provide.

Because it’s important to be properly insured, you may need to show proof of specific kinds of business insurance to become licensed and bonded. First, visit our page bonded vs insured to understand the difference between a surety bond and traditional insurance. If your profession does not require a license, you cannot get licensed and bonded but should still get insured.